43 difference between coupon rate and market rate

Coupon Rate Definition - Investopedia 28-05-2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Difference Between Gold Karats - 24K, 22K, 18K, 14K, 10K | Melorra In 22K gold, only 91.67 per cent is pure gold. The remaining 8.33 per cent consist of metals like silver, zinc, nickel or other alloys. Although it is used in making plain gold jewellery, 22K gold isn’t preferable form to make any heavy studded gold jewellery.It is because diamonds and other precious gemstones have their weights while 22 karat gold is softer than these stones and is ...

Difference Between LED and QLED 24-06-2019 · Difference Between LED and QLED Television displays have been rapidly evolving since the inception of LCD technology in the late 1990s which almost kicked the CRT business out of the market. The world was only beginning to understand the LCD technology that LEDs surfaced which changed the course of history. First it was LCD, then LED, and now we have

Difference between coupon rate and market rate

Current Yield vs. Yield to Maturity: What’s the Difference? 30-06-2022 · With these two examples, you can see the role a bond’s current market price plays in its yields. The ABC 7% bond is selling at a premium to the $1,000 face value, likely because the coupon rate of 7% is much higher than current interest rates. So the current yield is lower than the coupon payment. What's the Difference Between Premium Bonds and Discount Bonds? A premium bond has a coupon rate higher than the prevailing interest rate for that bond maturity and credit quality. A discount bond, in contrast, has a coupon rate lower than the prevailing interest rate for that bond maturity and credit quality. An example may clarify this distinction. Let's say you own an older bond—one that was ... What are the contract rate and the market rate for bonds ... - Answers Best Answer. Copy. Contract rate is known as a coupon rate (because older securities actually had coupons that were clipped and sent to paying banks for periodic interest). It is the fixed rate of ...

Difference between coupon rate and market rate. Today Gold Rate: 22 & 24 Carat Gold Price in India: 29 August 2022 29-08-2022 · Today Gold Rate (29 August 2022) : Get Current / Today's 22 Carat & 24 Carat Gold Price in India based on rupee per 1 gram & 10 gram. Also know last 10 days gold price, trend of gold rate & comparison of 22 & 24 Karat across various cities in India including Delhi, Bangalore, Chennai, Hyderabad & Mumbai etc. What is difference between coupon rate and interest rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates. What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons. Difference Between Coupon Rate and Interest Rate The main difference is that the decider of these rates; the coupon rate is decided by the issuer whereas the interest rate is decided by the lender. Both of these rates are expressed as annual percentages, but the situations that they use are particularly different. Admin

Bond Stated Interest Rate Vs. Market Rate - PocketSense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics What is the difference between coupon rate and market A coupon rate is the yield paid by a fixed income security, a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bonds face or par value. The coupon created the yield the bond paid on its issue date. What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Difference Between Coupon Rate and Required Return The coupon rate does is independent of the market value. The required return is dependent on the dividend value. The coupon rate is directly dependent on the bond price, whereas the required return is directly dependent on the risk involved. Coupon Rate has a risk on investment due to the fluctuations of the coupon rate.

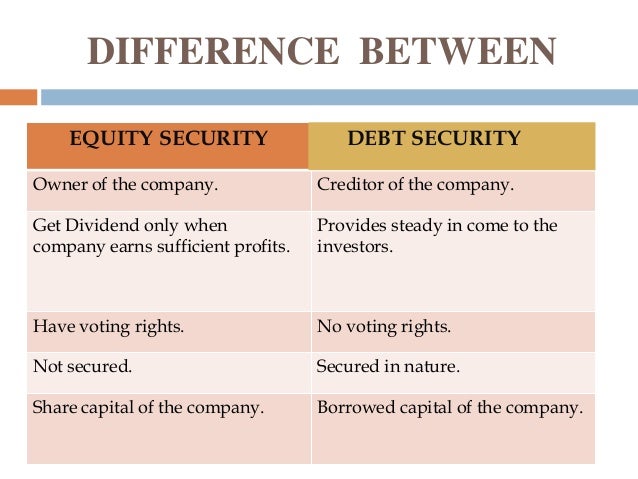

The Difference between a Coupon and Market Rate - BrainMass Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary Business Finance - Interest Rates and Bond Valuation YTM is another term for the bond's coupon rate. B. YTM is the yield that will be earned if the bond is sold immediately in the market. C. YTM is the prevailing market interest rate for bonds with similar features. ... D. Relationship between coupon rates and market yield. C. Which of the following is not a difference between debt and equity? A ... Solved What is the difference between a bond's coupon rate - Chegg O Coupon rate and market rate are same. The coupon rate is the rate specified on the face of the bond. The market rate is the rate of return expected by investors who purchase the bonds. The market rate is the rate specified on the face of the bond. The coupon rate is This problem has been solved! See the answer Show transcribed image text Discount Rate vs Interest Rate | Top 7 Differences (with … Also, the discount rate is considered as a rate of interest, which is used in the calculation of the present value Present Value Present Value (PV) is the today's value of money you expect to get from future income. It is computed as the sum of future investment returns discounted at a certain rate of return expectation. read more of the future cash inflows or outflows.

Coupon Rate Calculator | Bond Coupon 15-07-2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you …

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements.

What's the difference between the cost of debt and a coupon rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

Answered: What is the difference between the… | bartleby Solution for What is the difference between the coupon rate and the current market interestrate of a bond? Skip to main content. close. Start your trial now! First week only $4.99! arrow ... What is the difference between the coupon rate and the current market interest

Solved What is the difference between a bond's coupon rate - Chegg Expert Answer. 100% (2 ratings) A bond's coupon rate is the actual amount of interest income that the holder of a bond earns each year. The coupon rate …. View the full answer.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Difference Between Discount Rate and Interest Rate Interest rates and discount rates are rates that apply to borrowers and savers who pay or receive interest for savings or loans. Interest rates are determined by the market interest rate and other factors that need to be considered, especially, when lending funds. Discount rates refer to two different things. While discount rates are the rates ...

Discount Rate vs Interest Rate | 7 Best Difference (with Both Discount Rate vs Interest Rate are popular choices in the market; let us discuss some of the major Difference Between Discount Rate vs Interest Rate: The interest rate is the amount charged by a lender to a borrower for the use of assets. The lenders here are the banks and the borrowers are the individuals.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Coupon Rate vs. Yield-to-Maturity The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate is the annual amount of interest that the owner of the bond will receive. To complicate things the coupon rate may also be referred to as the yield from the bond. Generally, a bond...

Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond Current Yield = Annual Payments / Market Value of the Bond Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with its face value. Bond's price is calculated by considering several other factors, including: Bond's face value

Finance exam 2 Flashcards | Quizlet The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features. Which of the following terms apply to a bond? Coupon rate Dividend yield Time to maturity Par value

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held...

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond , which is being invested. The interest rate is calculated considering the basis of the riskiness of lending the amount to the borrower. The coupon rate is decided by the issuer of the bonds to the purchaser.

Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

What is the difference between the coupon rate and market rate? What is the difference between the coupon rate and market rate? No. of Words. 539. PRICE. $5.00. User Ratings. 0/5. 0 ratings. 0 ratings X.

Post a Comment for "43 difference between coupon rate and market rate"