44 relationship between coupon rate and ytm

› ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · The YTM formula is a more complicated calculation that renders the total amount of return generated by a bond based on its par value, purchase price, duration, coupon rate, and the power of ... Solved Par value Coupon interest rate Years to | Chegg.com Calculate the yield to maturity (YTM ) for the bond. (2 decimal places) b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value; Question: Par value Coupon interest rate Years to maturity Current value $100 7 % 14 $70 a. Calculate the yield to maturity (YTM ) for the bond.

Solved The bond shown in the following table pays | Chegg.com (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Par value $1,000 Coupon interest rate 9% Years to maturity 8 Current value $820 a. Calculate the yield to maturity (YTM) for the bond. b.

Relationship between coupon rate and ytm

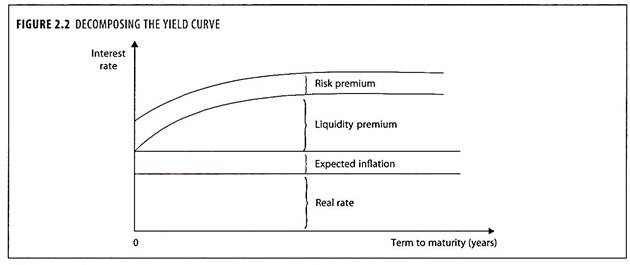

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. (Solved) - What is the relationship between the current yield and YTM ... A discount bond is when the ... › Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate.

Relationship between coupon rate and ytm. Relationship Between Coupon Rate Yield To Maturity And Current Yield yield and rate maturity relationship current coupon to yield between. The enclosure is a patented, durable design which interlocks with the jump mat v-rings using a button-hole feature, eliminating gaps. relationship between coupon rate yield to maturity and current yieldgap 40 off coupon december 2012. American Paint Horse Gifts investspectrum.com › uma › duration-vs-maturityDuration vs. Maturity and Why the Difference Matters Sep 01, 2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8% ... What is the relationship between YTM and the discount rate of a bond? Answer (1 of 3): They can be considered part of the same thing and depends on the type of bond. Yield to maturity is a concept for fixed rate bonds and is the internal rate of return i.e. the rate at which future flows are discounted on a compound basis to give the present value of the bond incl... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes If the coupon rate < YTM, the bond will sell for less than par value, or at a discount. If coupon rate= YTM, the bond will sell for par value. Over time, the price of premium bonds will gradually fall until they trade at par value at maturity. Similarly, the price of discount bonds will gradually rise to par value as maturity gets closer. What are interest rates, coupon rates, yield and YTM - Times Now Now let us look at the relationship between interest rates and bonds that are traded on such exchanges. Let us assume that you bought a bond for Rs 100 of ABC Company with a coupon rate (rate which ABC Company has agreed to pay the purchaser/you) of 8% and a tenor of 2 years. Now when the interest rates go down, ABC Company will issue its new ... How to calculate Spot Rates, Forward Rates & YTM in EXCEL 31.01.2012 · 3 mins read a. How to determine Forward Rates from Spot Rates. The relationship between spot and forward rates is given by the following equation: f t-1, 1 =(1+s t) t ÷ (1+s t-1) t-1-1. Where. s t is the t-period spot rate. f t-1,t is the forward rate applicable for the period (t-1,t). If the 1-year spot rate is 11.67% and the 2-year spot rate is 12% then the forward rate applicable … What relationship between a bond's coupon rate and a bond's yield would ... If the coupon rate is above the market rate for similarly risky bonds, then you will have to pay more for the bond, because everyone else will want to bid on that bond as well. By paying more for the bond, you have reduced its effective yield down to the market rate of interest. No free lunch. Uttam K. Gulshan

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. What is the relationship between the yield of a bond and price of the ... So a rise in price will decrease the yield and a fall in the bond price will increase the yield. The calculation for YTM is based on the coupon rate, the length of time to maturity and the market price of the bond. YTM is basically the Internal Rate of Return on the bond. The Ceteris Paribus Assumption - A Level and IB Economics. Chapter 6 -- Interest Rates Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually. The market price of the bond is $910.00. What should be YTM for the bond? YTM = 3.64%*2 = 7.28% (3) Yield to call: the return from a bond if it is held until called Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually. The market price of ... financetrainingcourse.com › education › 2012How to calculate Spot Rates, Forward Rates & YTM in EXCEL Jan 31, 2012 · c. How to calculate the Yield to Maturity (YTM) of a bond. The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond).

dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. Coupon Payment Frequency - How often the bond pays out interest every year. Calculator Outputs. Yield to Maturity (%): The yield you'd recognize holding the bond until maturity (assuming you receive all payments).

Coupon vs Yield | Top 5 Differences (with Infographics) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let's see the top differences between coupon vs. yield.

Basis Point Value - Overview, Bond Yields and Prices 31.08.2021 · Therefore, a bond’s yield to maturity is calculated. YTM is the interest rate at which the price of a bond equals the adjusted or present value of the cash flows expected to be generated in the future. Relationship Between Bond Yields and Bond Prices 1. Nature of relationship. Bond yields and their prices share an inverse relationship. It ...

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Current Yield - Relationship Between Yield To Maturity and Coupon Rate Famous quotes containing the words relationship, yield, maturity and/or rate: " We must introduce a new balance in the relationship between the individual and the government—a balance that favors greater individual freedom and self-reliance. —Gerald R. Ford (b. 1913) " Never yield to that temptation, which, to most young men, is very strong, of exposing other people's weaknesses and ...

Current Yield vs. Yield to Maturity - Investopedia 13.12.2021 · Conversely, when a bond sells for less than par, which is known as a discount bond, its current yield and YTM are higher than the coupon rate. Only on occasions when a bond sells for its exact par ...

Duration vs. Maturity and Why the Difference Matters 01.09.2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8% ...

Yield to Maturity (YTM): Formula and Excel Calculator The relationship between the current YTM and interest rate risk is inversely proportional, which means the higher the YTM, the less sensitive the bond prices are to interest rate changes. Yield to Maturity (YTM) vs Current Yield. The yield to maturity (YTM), as mentioned earlier, is the annualized return on a debt instrument based on the total payments received from the date of …

Bond Yield | Nominal Yield vs Current Yield vs YTM Where P 0 is the current bond price, c is the annual coupon rate, m is the number of coupon payments per year, YTM is the yield to maturity, n is the number of years the bond has till maturity and F is the face value of the bond.. The above equation must be solved through hit-and-trial method, i.e. you plug-in different numbers till you get the right hand side of the equation equal to the left ...

How to Calculate Yield to Maturity: 9 Steps (with Pictures) 06.05.2021 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. Remember, though, you're plugging in an estimated i for semi-annual payments. That ...

› yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

The Relationship Between a Bond's Price & Yield to Maturity The Relationship Between a Bond's Price & Yield to Maturity When you buy a bond, an important part of your return is the interest rate that the bond pays. However, yield to maturity is a more accurate representation of the total return you'll get on your investment.

What is the difference between YTM and coupon rate? The YTM calculation takes into account: coupon rate, the price of the bond, time remaining until maturity, and the difference between the face value and the price. It is a rather complex calculation. The coupon rate, or, more simply stated, coupon of a particular bond, is the amount of interest paid every year. Is coupon rate annual or semi annual?

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It …

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. ... The above graph shows the relationship for price and yield using the default values in the tool. Note the following outputs: Current YtM: Computed current yield to maturity; Current Price: Current bond trading price; X-Axis: Plus and minus 3% changes in market yield; Y-Axis: Estimated price …

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

The Relation of Interest Rate & Yield to Maturity - Pocketsense Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and maturity date. In the example, if you paid a premium for the same six-year bond, say $101, your estimated YTM would decrease to about 4.8 percent, or about $28.80.

Relationship Between Coupon and Yield - Assignment Worker Coupon rate = 14%, semiannual coupons YTM = 16% Maturity = 7 years Par value = $1,000 Slide 14 6-14 Example 7.1 • Semiannual coupon = $70 • Semiannual yield = 8% • Periods to maturity = 14 • Bond value = • 70 [1 - 1/ (1.08)14] / .08 + 1000 / (1.08)14 = 917.56 ( ) ( )2t 2t 2 YTM1 F 2 YTM 2 YTM1 1 -1 2 C Value Bond + + + =

Post a Comment for "44 relationship between coupon rate and ytm"