44 10 year treasury bond coupon rate

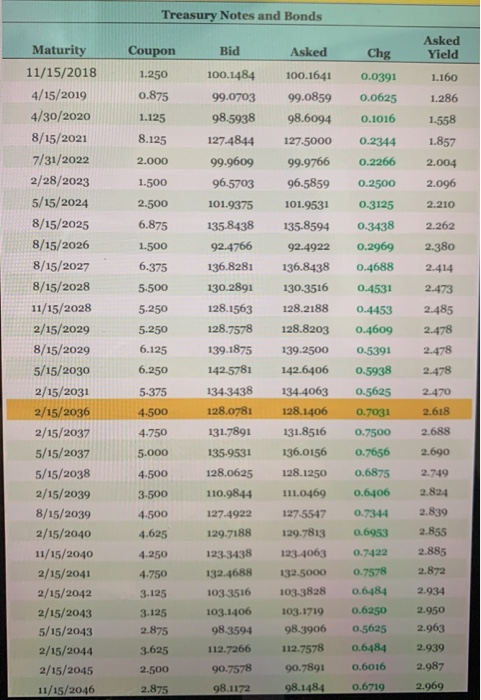

US 10 year Treasury Bond, chart, prices - FT.com May 12, 2022 · US 10 year Treasury US10YT US 10 year Treasury Yield2.79 Today's Change0.001 / 0.05% 1 Year change+71.05% Data delayed at least 20 minutes, as of May 20 2022 22:05 BST. More Summary Charts More 1D... Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present

10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once every six months and pays the face valueto the holder at maturity. The U.S. government partially funds itself by issuing 10-year Treasury notes.

10 year treasury bond coupon rate

10 Year Treasury Rate - YCharts May 06, 2022 · Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 2.91%, compared to 2.99% the previous market day and 1.64% last year. This is lower than the long term average of 4.28%. Stats Related Indicators Treasury Yield Curve 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of May 09, 2022 is 3.05%. Show Recessions Download Historical Data Export Image 10-Year U.S. Treasury Note: Definition, Why It's the Most ... The U.S. Treasury creates each bond issue, each in increments of $100 and paying a pre-specified amount of interest called its "coupon yield." They are initially offered to investment banks via an auction conducted by the Federal Reserve, who in turn offer them to their investors on the secondary market all around the world.2This is where "market y...

10 year treasury bond coupon rate. 10-Year U.S. Treasury Note: Definition, Why It's the Most ... The U.S. Treasury creates each bond issue, each in increments of $100 and paying a pre-specified amount of interest called its "coupon yield." They are initially offered to investment banks via an auction conducted by the Federal Reserve, who in turn offer them to their investors on the secondary market all around the world.2This is where "market y... 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of May 09, 2022 is 3.05%. Show Recessions Download Historical Data Export Image 10 Year Treasury Rate - YCharts May 06, 2022 · Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 2.91%, compared to 2.99% the previous market day and 1.64% last year. This is lower than the long term average of 4.28%. Stats Related Indicators Treasury Yield Curve

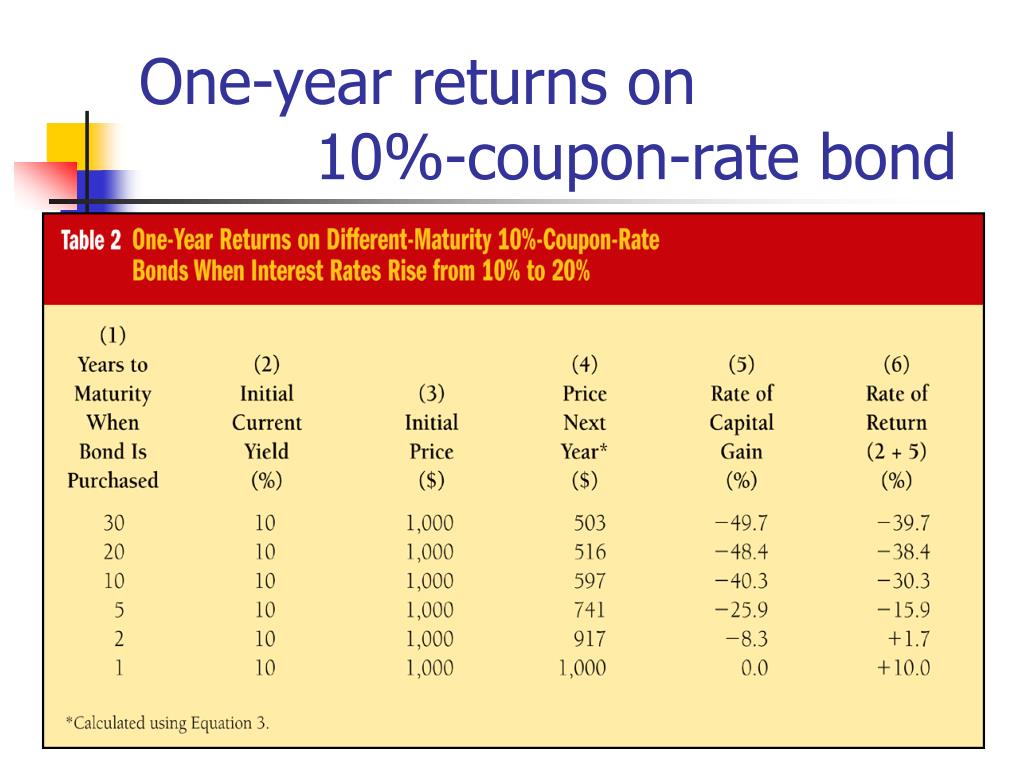

Practice problems - Consider a bond paying a coupon rate of 10 per year semiannually when the ...

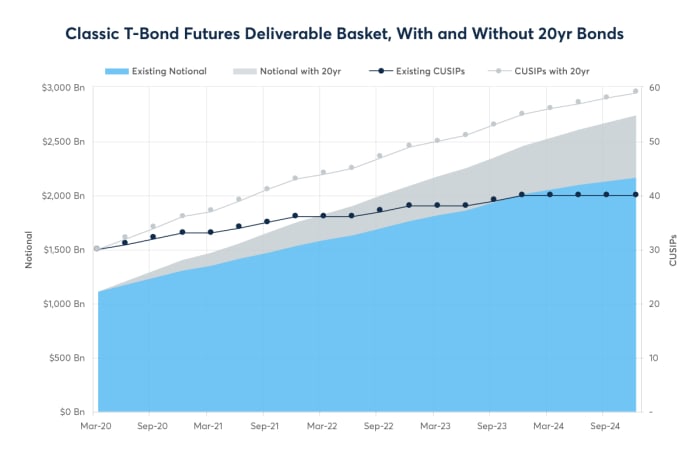

Federal Funds Rate vs. Discount Rate: Dissecting the U.S. Treasury Coupon Curve - iShares 20 ...

Post a Comment for "44 10 year treasury bond coupon rate"